Motilal Oswal Review : Margin, Commodities, Mutual Funds, IPOs

Motilal Oswal was incorporated in 1987 and is one of the oldest stock broking firms in India. Motilal Oswal Securities Ltd. (MOSL) is based in Mumbai, India.

It is diversified financial services firm. The company offers trading services in Equity, Commodity, Currency and Derivatives.

It also offers other products like Mutual Funds, IPOs, Gold, Insurance and Fixed Income products.

It has a diversified client base that includes retail customers which includes High Net worth Individuals, mutual funds, foreign institutional investors, financial institutions and corporate clients.

It is one of the leading full service stock brokers in India and is known for its trading applications, portfolio management services and quick customer support.

Motilal Oswal Securities Founders

Motilal Oswal Securities Ltd. was founded by Mr. Motilal Oswal and Mr. Ramdeo Aggarwal. The Full-service broker is depository participant of both CDSL and NSDL. Motilal Oswal is a SEBI registered stockbroker and a listed member of NSE and BSE.

Motilal Oswal extends following service to its clients :

- Share market

- Motilal Oswal Wealth Management Services.

- Retail broking and Distribution.

- Institutional Broking

- Asset Management

- Investment Banking

- Home Finance

- Private Equity

By opening an account with the stock broker, a trader is allowed the opportunity to trade and invest across different financial instruments.

Motilal Oswal has seen organic and inorganic growth over the years. It acquired a south Indian brokerage firm – Peninsular Capital Markets. While in 2010, it started dealing with mutual funds after getting approval from SEBI. Today the group has its presence in 2200 locations through its sub-broker and franchise network to go along with around 1 million customers .

Earlier Motilal Oswal had its focus on institutional broking now gradually it has been pivoting towards full-service retail stockbroking.

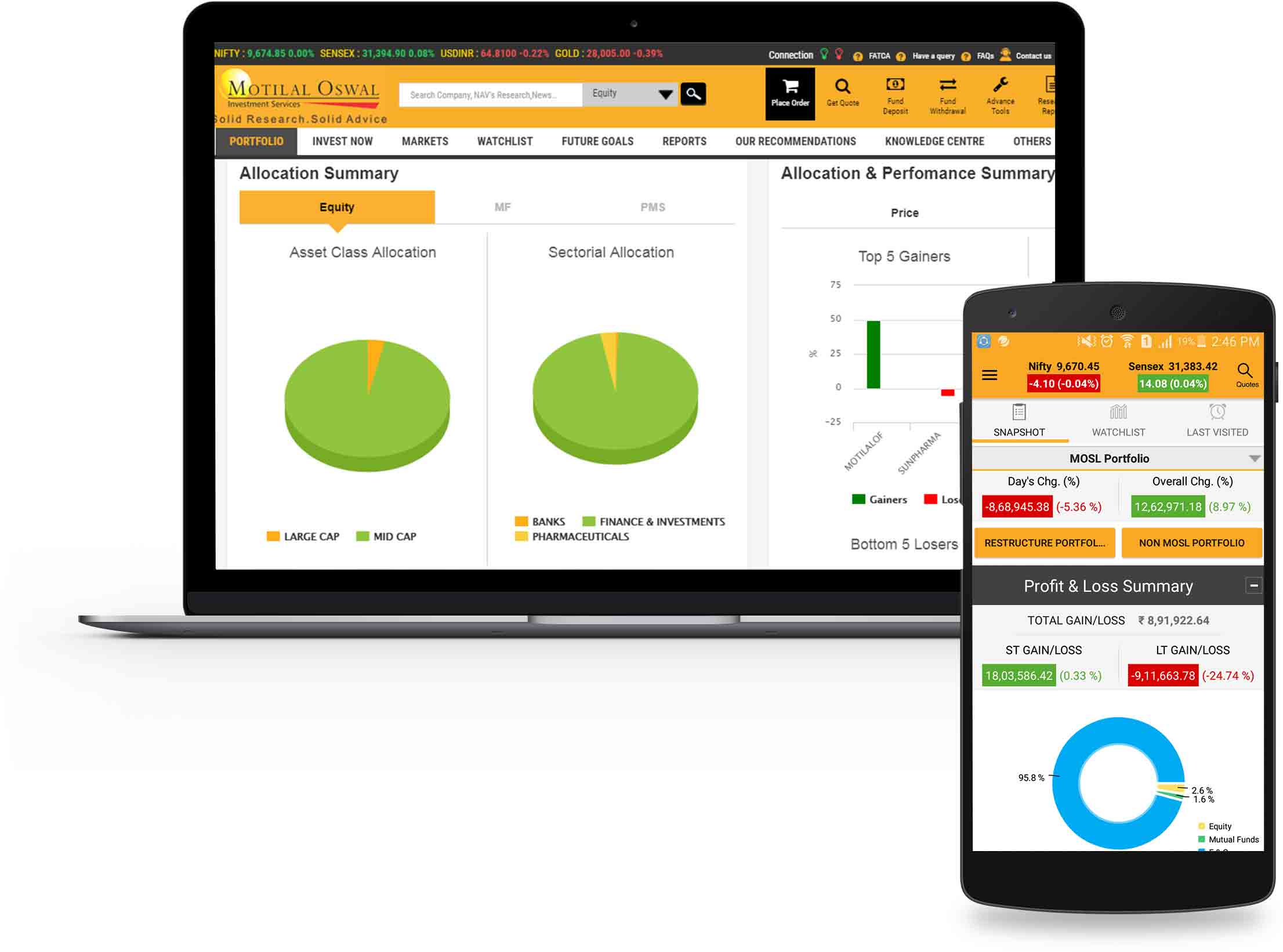

Motilal Oswal Trading App

Motilal Oswal Trading App is another advantage of opening an account with the stockbroker. This full-service stockbroker offers multiple trading platforms across various devices offering all sorts of usable features which simplify the Motilal Oswal trading experience.

The platforms help traders set up a Demat Account, keep a track of the market as well as execute trades when the right opportunity arrives.

Motilal Oswal Desktop Application

This application provides super-fast execution of trades. Download this application from their Website and install on the desktop or laptop. Some of the features of Motilal Oswal desktop application includes :

- Options Strategy Builder : Traders can choose from a variety of options strategies.

- F&O Analytics : Get extensive market information like gainers/losers, most active stocks, top events, news, and much more across asset classes integrated with the trading portal.

- Technical Indicators : The app has technical indicators and charts that will help traders evaluate market depth.

- Research Reports : Traders get access to over 30000 research reports within the app.

- Trade ideas : Trade guide signal to auto-generate buying and selling ideas.

Motilal Oswal trading terminal is known for good speed and decent user experience but at the same time is bulky as well. To have a good experience it is necessary to have a laptop or PC with good system configuration.

Motilal Oswal Mobile App

Motilal Oswal App provides information on the go. The mobile app has following features

- Watchlists : Multi asset watch-lists with real time quotes and advanced charts.

- Market Screeners : The app has 19 market screeners that ensure a trader never misses out on trading opportunities.

- News : Users can get updates about the latest events, news of various stocks, companies and sectors.

- Trading reports : Users can access these reports to refer to their trading activities and make better trading decisions.

- Portfolio Monitoring Tools : Real – time portfolio monitoring tools.

- Motilal Oswal Fund Transfer : Funds transfer allowed across more than 60 banks.

- Secure Platform : Secure mobile trading experience with a one-time login feature.

- Motilal Oswal Stop Loss Order : This feature enables the trader to minimise the risk while price fluctuations by limiting the amount fixed for stop loss.

Motilal Oswal Smartwatch app

Following are the Motilal Oswal Smartwatch app features :

- Notifications : Traders get all market updates through instant notifications.

- Market update : Instant information on global indices, market top losers and gainers.

- Portfolio : Traders can view their portfolio across asset classes.

- Check Margin : This feature allows traders to check Motilal Oswal margin in both cash and commodities segment.

- Position Update : Get updates on open positions.

Motilal Oswal Trade

Motilal Oswal Trader Web is a web based trading platform for users who like to access browser-based applications. The key features of web-portal are :

- Power Trade : Traders can buy or Sell order through just one click.

- Bulk order : Trader can save orders and later execute them all in one go.

- Price Alert : Set price alerts at price levels. This feature ensures traders never miss out on an opportunity.

- One view Dashboard : Gives a quick snapshot of the account in a single view including cash balance, positions, order status, portfolio performance across timelines and market data.

- Mutual Funds : Provides the flexibility of selecting the Mutual Funds one wishes to purchase or the option to choose from expert recommendations.

Motilal Oswal Charges

There are multiple kinds of charges Motilal Oswal clients have to pay.

| Trading account opening charges | Rs.1000 |

| Trading Annual maintenance charges | Rs. 0 |

| Demat Account opening charges | Rs. 0 |

| Demat Account Annual Maintenance Charges | Rs. 441 |

Motilal Oswal Brokerage

Motilal Oswal Brokerage is negotiable and depends on the account a client holds in their account. The brokerage charges are expensive.

| Segment | Brokerage |

| Equity Delivery | 0.50% |

| Equity Intraday | 0.05% |

| Equity Futures | 0.05% |

| Equity Options | Rs 100 per lot |

| Currency Futures | Rs 20 per lot |

| Currency Options | Rs 20 per lot |

| Commodity | 0.05% |

Motilal Oswal Brokerage Plans

The value pack is a subscription based plan where you need to pay a certain upfront amount based on which the corresponding brokerage charges are applied. The payment made in this plan is non-refundable.

Motilal Oswal Value Pack Plans

Value pack is an upfront subscription scheme, which provides reasonable discounts on brokerage rates with a defined time period to use it. With a wide range of value packs based on the volume of trade and the validity period one can enjoy the benefits of placing trades at reduced charges.

Motilal Oswal Transaction Charges

| Equity Delivery | 0.00335% |

| Equity Intraday | 0.00325% |

| Equity Futures | 0.00200% |

| Equity Options | 0.05110% |

| Currency Futures | 0.00125% |

| Currency Options | 0.04200% |

| Commodity | 0.00325% |

Motilal Oswal Margin

Traders who do not want to pay the complete purchase price of stocks upfront can avail Motilal Oswal Margin Facility. Motilal Oswal broker offers Motilal Oswal Margin Scheme for Margin traders. The brokerage charges in these schemes vary based on the margin amount held by the trader.

| Segment | Brokerage |

| Equity Delivery | Currency Options |

| Equity Intraday | 0.015% to 0.05% |

| Equity Futures | 0.015% to 0.05% |

| Equity Options | Rs 25 to Rs 100 per lot |

| Currency Futures | Rs 20 per lot |

| Currency Options | Rs 20 per lot |

| Commodity | 0.015% to 0.05% |

Motilal Oswal Customer Care

After activation of Motilal Oswal demat account the full stock broker provides the following communication channels to their clients.

- Phone

- Offline Branches

- Social Media

Motilal Oswal Research

Motilal Oswal Research is counted to be the best research facilities in the Indian Market. Motilal Oswal claims to provide more than 30,000 research reports encompassing 260 stocks covering 21 sectors through 40 types of different reports. Few of the reports are listed below :

Company reports

These reports talk about the fundamentals of different companies listed on different exchanges of India. These reports also contain details about economic events happening at the state and country levels that can directly or indirectly impact specific sectors and respective company stocks.

Thematic Reports

Thematic Reports are theme based research outputs coming from some of the latest events across industries and business domains.

Market Analysis Reports

These reports contain numerous reports like Market roundup, currency reports etc. The reports are published on daily basis.

Motilal Oswal Rating

| Parameter | Rating |

| Trading Platform | 8.5/10 |

| Research & Tips | 8.0/10 |

| Pricing & Brokerage | 7.5/10 |

| Customer Support | 8.0/10 |

| Exposure | 8.0/10 |

| Overall Rating | 8.0/10 |

This was the review about Motilal Oswal Securities. We hope that you found the article informative. Please share the article with your friends and stay tuned for updates.

Get access to market news, updates and trends; follow our telegram channel @onlinetradinginstitute

| Disclaimer: The sole purpose of our financial articles is to provide you with educational and informative content. The content in these articles does not intend any investment, financial, legal, tax, or any other advice. It should not be used as a substitute for professional advice or assistance. |