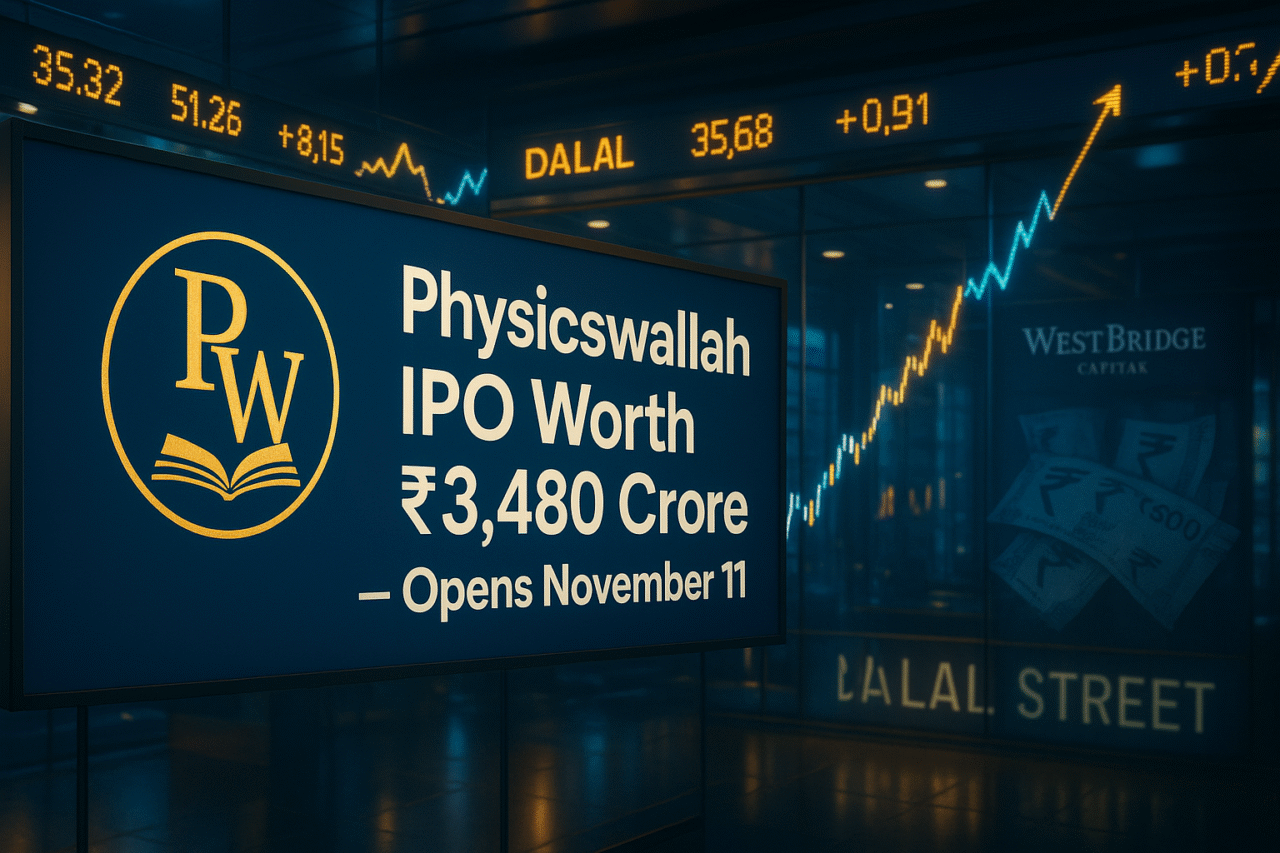

India’s Ed-Tech Giant, PhysicsWallah IPO Worth ₹3,480 Crore to Open on November 11! Check Key Details

Physicswallah IPO: The upcoming Physicswallah IPO size is turning heads across Dalal Street and beyond. With the company planning to raise a ₹3,000-4,600 crore public issue, the ed-tech player is poised to make a mark in the Indian stock market.

In this article, we break down the Physicswallah IPO key details, issue size, review its recent financials, examine the pros and cons for Indian investors, and explore how the broader ed-tech sector may respond.

What Are the Key Details of the PhysicsWallah IPO?

| Parameter | Details |

|---|---|

| IPO Open Date | November 11, 2025 |

| IPO Close Date | November 13, 2025 |

| Price Band | ₹103 – ₹109 per share |

| Issue Size | ₹3,480 crore |

| Fresh Issue | ₹3,100 crore |

| Offer for Sale (OFS) | ₹380 crore |

| Lot Size | 137 shares |

| Listing Date | November 18, 2025 |

| Exchanges | NSE & BSE |

| Valuation (Upper Band) | ~₹31,500 crore (~US$3.19 billion |

How Will the IPO Proceeds Be Utilized?

PhysicsWallah plans to deploy its IPO proceeds toward multiple strategic goals:

- Expanding offline and hybrid learning centres across India

- Investing in technology, cloud, and digital infrastructure

- Strengthening marketing and brand-building efforts

- Funding future acquisitions and partnerships

- Covering general corporate purposes

What Are the Major Strengths and Weaknesses of PhysicsWallah?

| Strengths | Weaknesses |

|---|---|

| Rapid revenue growth over three years | Still posting net losses |

| Strong online-offline hybrid presence | High employee & infrastructure costs |

| Massive student community and brand loyalty | Competitive and crowded edtech market |

| Affordable pricing model & Tier II penetration | Execution challenges in scaling offline |

| First mover among Indian edtech IPOs | Reliance on exam-driven segments |

Who Are PhysicsWallah’s Closest Competitors?

| Company | Status / Notes |

|---|---|

| PhysicsWallah Ltd | Upcoming IPO; FY25 revenue ₹2,887 crore |

| BYJU’S | Unlisted; ongoing restructuring and funding crunch |

| upGrad | Private; focusing on adult upskilling |

| Vedantu | Private; smaller offline presence |

Currently, there are no directly comparable listed peers in India’s edtech space, giving PhysicsWallah a potential “first-mover” advantage on Dalal Street.

Who Are the Promoters and Key Shareholders?

| Promoter / Investor | Pre-IPO Holding |

|---|---|

| Alakh Pandey | ~40.35% |

| Prateek Maheshwari | ~40.35% |

| WestBridge Capital | ~7–8% |

| GSV Ventures, Lightspeed, Hornbill Capital | ~10–12% collectively |

How Does the Promoter Holding Look Post-IPO?

Estimated Post-IPO Shareholding:

- Founders: ~65–68% combined

- Institutional Investors: ~15%

- ESOPs & Employees: ~5%

- Public Shareholders: ~10–12%

What is the Physicswallah IPO size and structure?

The IPO structure and size are central to understanding its potential impact. Here’s a snapshot:

| Component | Approximate Value* | Notes |

|---|---|---|

| Fresh issue | ~ ₹3,100 crore | Funds to be raised by new equity issuance. |

| Offer-for-sale (OFS) | ~ ₹720-₹720 crore | Promoters (co-founders) selling shares. |

| Total IPO size | ~ ₹3,820 crore | Earlier estimates for combined fresh + OFS. |

| Larger estimates | ~ ₹4,600 crore | Some sources report upto this size. |

How Has PhysicsWallah Performed Financially in the Last Three Years?

| Fiscal Year | Revenue (₹ Cr) | Net Profit / Loss (₹ Cr) | YoY Growth |

|---|---|---|---|

| FY23 | 744 | -85 | — |

| FY24 | 1,940 | -1,131 | +160% |

| FY25 | 2,887 | -243 | +49% |

Key Financial Ratios

| Metric | FY25 | FY24 | Remarks |

|---|---|---|---|

| EBITDA Margin | 6.7% | -42.7% | Turned positive; strong recovery |

| ROCE | -6.3% | -14.2% | Efficiency improving |

| Cost per ₹1 Revenue | ₹1.13 | ₹1.69 | Better cost control |

| Offline ARPU | ₹40,405 | ₹32,000 | Strong monetization per learner |

What Are the Biggest Opportunities and Risks for Investors?

Opportunities:

✅ Rising demand for affordable education in smaller cities

✅ Rapidly growing hybrid learning ecosystem

✅ Strong brand recall and loyal student base

✅ Massive market potential in test prep & government exams

Risks:

⚠️ Still loss-making though losses are narrowing

⚠️ High marketing & offline expansion costs

⚠️ Competition from deep-pocketed rivals

⚠️ Dependence on JEE/NEET results-driven revenue cycles

Should You Consider Investing in the PhysicsWallah IPO?

The PhysicsWallah IPO brings both promise and prudence for investors.

On one hand, the company has shown exceptional revenue growth, a strong brand, and a scalable hybrid model. On the other, profitability remains elusive, and offline expansion could pressure margins in the near term.

For long-term investors who believe in the future of affordable, scalable Indian education, this IPO may offer an early opportunity to own a piece of India’s most trusted edtech story.

Key takeaway:

If you’re looking at the ed-tech space, mark “Physicswallah IPO size” as a milestone.

Watch for: (1) listing premium or discount, (2) investor demand especially from retail + HNI, (3) how the company communicates margins, and (4) how the sector responds. This one could define how the next generation of Indian ed-tech stocks perform.

PhysicsWallah IPO Frequently Askes Questions (FAQs)

1. When will the PhysicsWallah IPO open?

It will open on November 11, 2025, and close on November 13, 2025.

2. What is the PhysicsWallah IPO price band?

The price range is set between ₹103 and ₹109 per share.

3. How many shares are in one lot of PhysicsWallah IPO?

Each lot consists of 137 shares, amounting to around ₹14,900 at the upper price band.

4. What is the total issue size of PhysicsWallah IPO?

The total issue size is ₹3,480 crore, including both fresh issue and OFS components.

5. Who are the founders of PhysicsWallah?

The company was founded by Alakh Pandey and Prateek Maheshwari.

6. What will the PhysicsWallah IPO funds be used for?

To expand offline centres, upgrade tech infrastructure, and fund marketing & acquisitions.

7. Is the company profitable?

Not yet, but losses have reduced sharply, indicating operational progress.

8. Where will the shares list?

On both NSE and BSE.

9. What are the company’s biggest competitive advantages?

Brand credibility, low-cost education model, and dominance in Tier II/III cities.

10. Should retail investors apply?

Yes, if they have a long-term horizon and believe in India’s growing edtech potential.

Click Here to know more market & IPO related news and updates.

Disclaimer: The views and investment insights provided here are based on publicly available information and do not constitute financial advice. Readers are advised to conduct their own research or consult certified financial experts before making investment decisions.