Tenneco Clean Air IPO Opens Nov 12 — Price Band, Allotment, Financials & Expert Verdict

Tenneco Clean Air IPO: The Tenneco Clean Air IPO is set to launch on November 12, offering Indian investors exposure to the auto-components boom in India. Tenneco Clean Air India Ltd is the Indian subsidiary of the U.S.-based Tenneco Inc. — a global Tier-1 supplier in the automotive component space specialising in clean air, powertrain and suspension solutions.

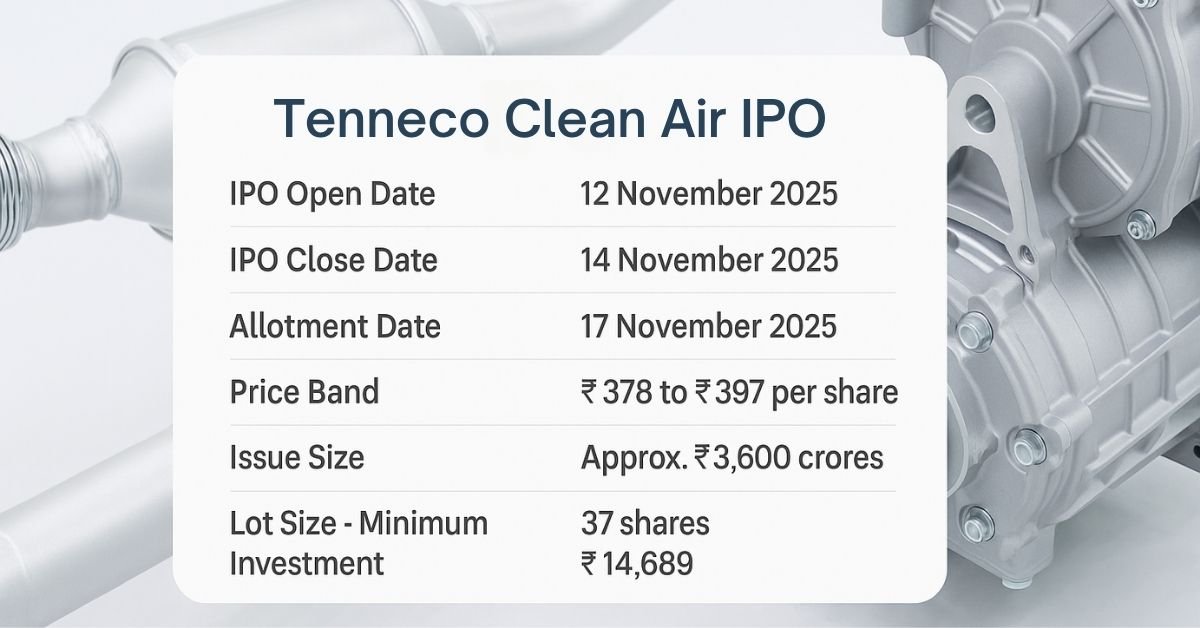

What are the Tenneco Clean Air IPO dates, price band, lot size and issue size?

IPO Key Parameters

| Parameter | Details |

|---|---|

| IPO Open Date | 12 November 2025 |

| IPO Close Date | 14 November 2025 |

| Allotment Date | 17 November 2025 |

| Listing Date | 19 November 2025 |

| Price Band | ₹378 to ₹397 per equity share (face value ₹10) |

| Issue Size | Approx. ₹3,600 crores (Offer For Sale of ~9,06,80,101 shares) |

| Lot Size / Minimum Investment | Minimum 37 shares → approx ₹14,689 at lower end of band |

| Reservation (Investor Category) | QIB 50 %, NII 15 %, Retail 35 % |

Note: As Tenneco Clean Air IPO is a complete Offer for Sale (OFS), the company will not receive fresh capital; the proceeds go to the selling shareholders.

Who are the Promoters and what’s the share-holding story?

The promoters of Tenneco Clean Air India include:

- Tenneco Mauritius Holdings Limited

- Tenneco (Mauritius) Limited

- Federal-Mogul Investments B.V.

- Federal-Mogul Pty Ltd

- Tenneco LLC

Promoter Shareholding Pre-Issue: 4,03,60,4,309 shares i.e., 100% (as per data)

Promoter Shareholding Post-Issue: According to another source: 74.79% post-issue.

What does the company do & what’s the business model?

Tenneco Clean Air India operates in automotive components — specifically: clean-air (exhausts, after-treatment systems, catalytic converters, diesel particulate filters), powertrain components, and suspension/ride-technology solutions.

In India, the company has 12 manufacturing plants (7 in Clean Air & Powertrain, 5 in Advanced Ride Technologies) across seven states and one UT.

What are the financials for the last three years & key ratios?

Financial Snapshot (in ₹ crore)

| Year ended 31 Mar | Revenue | Profit After Tax (PAT) | Net Worth |

|---|---|---|---|

| 2023 | 4,886.96 | 381.04 | 1,378.82 |

| 2024 | 5,537.39 | 416.79 | 1,116.59 |

| 2025 | 4,931.45 | 553.14 | 1,255.09 |

Key Ratios & Comments:

- ROE: ~42.65%

- ROCE: ~56.78%

- PAT Margin: ~11.31% (FY25)

- Debt to Equity: ~0.17

- EPS (Basic, FY25): ₹13.68 approx.

How does TCAIL compare with its peers?

Peer Comparison Snapshot

| Peer Company | Business Focus | Key Metric/Market Position |

|---|---|---|

| Bosch Ltd | Broad automotive components | Large diversified portfolio |

| Timken India Ltd | Power-transmission & component solutions | Smaller base but export oriented |

| SKF India Ltd | Bearings & related components | Niche but stable |

| Tenneco Clean Air India Ltd | Clean-air + powertrain + suspension systems | Leader in clean-air segment with regulatory tailwind |

Takeaway: Among auto-component players, TCAIL differentiates by its heavy orientation towards emission-control and after-treatment solutions — an area of rising regulatory focus. That gives it an edge versus peers more reliant on generic components. On the flip side, peers may have broader segmentation and thereby lower risk exposure.

What are the strengths & weaknesses of the Tenneco Clean Air IPO ?

Strengths:

- Technology-intensive niche in clean-air systems.

- Strong OEM relationships and high exportable content.

- Backed by a global player (Tenneco).

- Market conditions: Indian auto component demand, emission norms tightening, potential export tailwinds.

Weaknesses/Risks:

- Being OFS only, the company won’t benefit from fresh capital for expansion.

- Auto industry cyclicality and shift to EVs might reduce demand for exhaust/after-treatment systems over the longer term.

- Top-customer dependency, raw-material cost exposure.

- Revenue decline in FY25 despite rising profit; the topline drop may warrant closer scrutiny.

Conclusion

In a nutshell, the upcoming Tenneco Clean Air IPO presents an interesting thematic play — the auto-component space powered by emission-control and global OEM link-ups. For Indian investors, it offers access to a niche but growing segment.

However, the fact that it’s purely an OFS and not bringing fresh funds to the business tempers the appeal — the growth story will depend heavily on existing operations and external demand. If you believe in the structural shift to higher emission-standards and localisation of auto parts in India, this could be worth a close look — but ensure you’re comfortable with its risk profile.

Tenneco Clean Air IPO Frequently Asked Questions (FAQs)

1.What is the issue size of the Tenneco Clean Air IPO?

The issue size is approximately ₹3,600 crores via an Offer For Sale (~9.06 crore shares).

2.What is the price band and lot size for Tenneco Clean Air IPO?

Price band is ₹378 to ₹397 per share, minimum lot size is 37 shares (≈ ₹14,689 at lower band).

3.Will the company receive any funds from the IPO?

No — this is a 100% OFS (Offer for Sale), so the company will not receive fresh capital.

4.What is the business of Tenneco Clean Air India?

It manufactures and supplies clean-air systems (exhausts, after-treatment), powertrain and suspension components to OEMs and exports

5.What are the key financials of the company?

For FY2025: Revenue ~ ₹4,931 crores, PAT ~ ₹553 crores, Net Worth ~ ₹1,255 crores.

6.What are the main strengths of the company?

Technology-led business in emission control, strong OEM portfolio, leading market share in CV/OH clean-air systems in India.

7.What are the main risks or weaknesses?

Auto industry cyclicality, shift to EVs, no fresh capital raising, topline decline, customer-concentration risk.

8.Who are its peers and how does it compare?

Peers include Bosch, Timken India, SKF India. TCAIL stands out by its clean-air focus and regulatory tailwind.

9.How is the promoter shareholding structured?

Promoters hold 100% pre-issue; one source indicates ~74.79% post-issue.

10.Should I apply for the Tenneco Clean Air IPO?

That depends on your risk appetite and belief in the auto emission-control theme. The structural story is strong, but operational and market risks remain — do your own research and ensure it fits your portfolio.

Click Here to know more market & IPO related news and updates.

Disclosure: This article is for educational and informational purposes only and should not be construed as financial advice. Please consult a certified financial advisor before making investment decisions.