Park Medi World IPO: Healthcare Sector Giant Targets ₹920 Crore—Know Dates, Price, Financials, Strenghts & Weaknesses

The Park Medi World IPO marks its first public share sale — opening the hospital chain to public equity investors for expansion, debt repayment, and growth. The IPO is set to open on December 10 & close on December 12, 2025 with a price range of ₹154 to ₹162 per share.

Park Medi World Ltd. is a private hospital-chain operating under the “Park Hospital” banner, predominantly in North India. As of March/Sept 2025, it runs a network of multi-specialty hospitals, offering a broad range of services across specialties such as cardiology, neurology, oncology among others.

When and How — Park Medi World IPO Dates, Price Band & Lot-Size?

| Detail | Information |

|---|---|

| IPO Open Date | 10 December 2025 |

| IPO Close Date | 12 December 2025 |

| Price Band | ₹154 – ₹162 per share (Face Value ₹2 each) |

| Minimum Lot Size (Retail) | 92 shares per lot |

| Minimum Investment (Retail) | ₹14,904 (at upper price ₹162) |

| Retail Maximum (13 lots) | 1,196 shares — ₹1,93,752 |

| S-HNI (Small HNI) Min & Max | Min: 14 lots (1,288 shares, ~₹2,08,656); Max: 67 lots (6,164 shares). |

| B-HNI (Big HNI) Minimum | 68 lots = 6,256 shares, ~₹10,13,472. |

| Issue Size (Total) | ≈ ₹920 crore (Fresh Issue + Offer-for-Sale) |

| Fresh Issue Component | ≈ ₹770 crore |

| Offer-for-Sale (OFS) Component | Sale of ~92,59,259 shares by existing shareholders. |

| Tentative Allotment Date | 15 December 2025 |

| Tentative Listing Date (BSE/NSE) | 17 December 2025 |

Park Medi World IPO DRHP- Click Here

Why They’re Raising Money — Objects of the Park Medi World IPO?

Proceeds from the fresh issue of the Park Medi World IPO will primarily be used for:

- Repayment / prepayment (full or partial) of certain outstanding borrowings of the company and its subsidiaries — ₹380.00 crore

- Funding capital expenditure for development of a new hospital (Park Medicity, NCR) and expansion of an existing hospital (Blue Heavens) — ₹60.50 crore

- Purchase of medical equipment for company and certain subsidiaries — ₹27.46 crore

- For unspecified inorganic acquisitions and general corporate purposes (remainder)

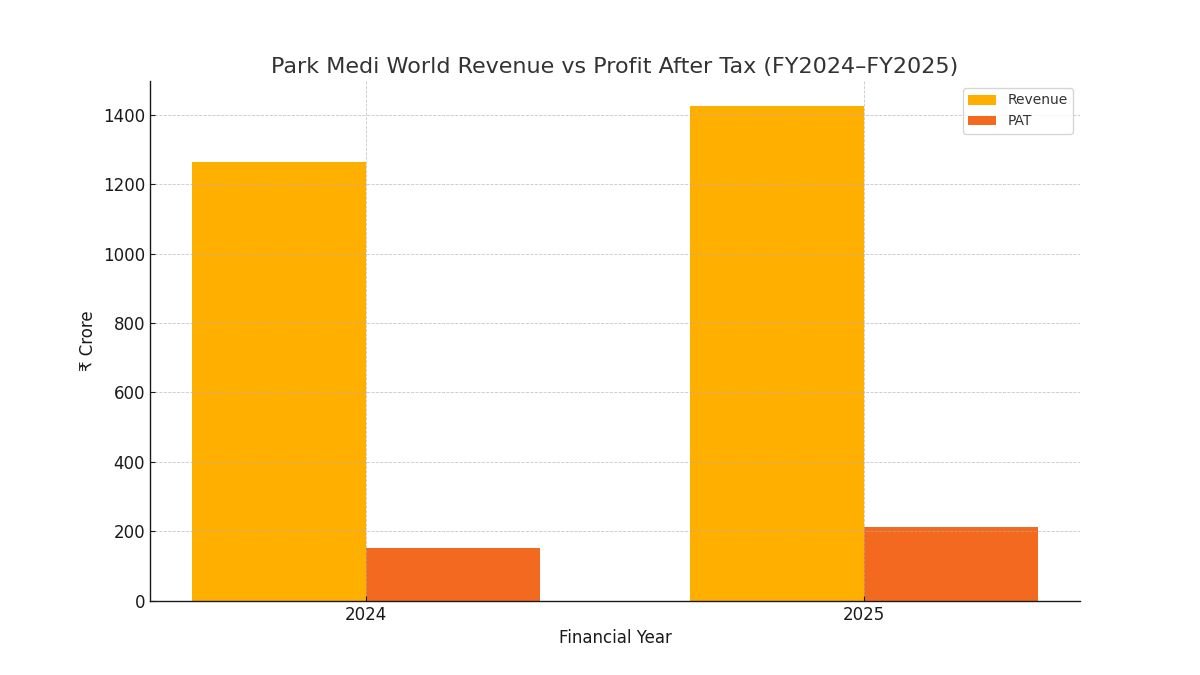

Historical Financials & Key Ratios (Last 3 Years)

Below is a consolidated table summarizing recent financial performance (as publicly reported) of Park Medi World.

| Fiscal Year ( Mar End ) | Total Revenue (₹ in crore) | Profit After Tax (₹ in crore) | Key Ratios* |

|---|---|---|---|

| 2025 | 1,425.97 | 213.22 | RoNW ~ 20.68%, ROCE ~ 17.47%, EBITDA margin ~ 26.7%, PAT margin ~ 15.3%, Debt-to-Equity ~ 0.61, EPS ₹5.55 |

| 2024 | 1,263.08 | 152.01–153.49 | (ratios for FY24 not always reported; 2025 used for multiple valuations) |

| 2023 | — | — | — |

*Ratios as per IPO documents / analysts’ summaries.

What Are the Strengths — Why Park Medi World Stands Out?

- Solid financial performance with margins

- Well-defined capital utilisation plan

- Attractive entry via manageable lot-size

- Growing hospital network and bed capacity

What Could Go Wrong — Risks & Weaknesses?

- Shift in profitability (PAT dip in FY2024)

- Execution risk for expansion & acquisitions

- Healthcare-sector dependencies

- Concentration risk

Where Does Park Medi World Fit-Peer Comparison?

Based on public filings summarised by IPO-watch sources, Park Medi World’s FY2025 ROE (20.68%) and PAT margin (15.30%) compare favourably to many peers.

While some larger hospital chains have broader geographic footprint and higher absolute revenue, Park Medi World’s combination of margin strength, relatively modest valuation (at IPO price band), and clear expansion plan positions it as a mid-to-large player with growth potential — especially for investors seeking exposure to healthcare at ground level.

Who Are The Promoters & Shareholding Pattern Post-IPO?

Promoters: Dr. Ajit Gupta and Dr. Ankit Gupta.

| Holding Pattern | Pre-Issue | Post-Issue |

|---|---|---|

| Promoter Holding | ~ 95.55% | ~ 82.89% |

Post-IPO, public shareholders will get a meaningful stake — improving liquidity and share-market participation.

Conclusion — Should You Consider Subscribing?

With robust recent financials, clear use of Park Medi World IPO proceeds, and a strong foothold in the private-hospital sector, Park Medi World’s IPO offers a disciplined entry point into healthcare. The accessible lot size, reasonable price band, and growth-oriented capital deployment make it an attractive proposition — especially for long-term investors betting on India’s rising demand for quality multi-specialty healthcare.

The potential investors should monitor execution risks, management of expansion, and overall sector dynamics before subscribing.

Top 10 FAQs About Park Medi World IPO:

1. What is the minimum lot size for Park Medi World IPO?

The lots size is 92 shares per lot; minimum retail application ₹14,904.

2. What are maximum shares a retail investor can apply for?

The retail investors can apply for up to 13 lots (1,196 shares, ₹1,93,752).

3. What is the Park Medi World IPO total issue size, and how is it structured?

Total issue ~ ₹920 crore: fresh issue ~₹770 crore + offer-for-sale of ~92.6 lakh shares by existing shareholders.

4. How does Park Medi World plan to use the IPO proceeds?

For repayment of borrowings (₹380 cr), development of new hospital, expansion of existing (₹60.5 cr), medical equipment purchases (₹27.46 cr), and general corporate purposes.

5. Who are the promoters and what will be their holding post-IPO?

Promoters: Dr. Ajit Gupta and Dr. Ankit Gupta. Their combined holding will fall from ~95.55% pre-IPO to ~82.89% post-IPO.

6. When will the IPO allotment and listing happen?

Allotment expected on 15 December 2025; listing on BSE & NSE tentatively on 17 December 2025.

7. Is the IPO a fresh issue or Offer-for-Sale or both?

It’s a mix: fresh issue (~₹770 cr) + Offer-for-Sale by promoter shareholders (~92.6 lakh shares) totaling roughly ₹920 cr.

Click Here to know more market & IPO related news and updates.

Disclaimer: The views and investment insights provided here are based on publicly available information and do not constitute financial advice. Readers are advised to conduct their own research or consult certified financial experts before making investment decisions.