India’s Biggest AMC Float! ICICI Prudential AMC IPO Opens On December 12- Know Dates, Price Range & Financials

With India’s mutual fund industry booming, the upcoming ICICI Prudential AMC IPO is creating ripples on Dalal Street. The IPO is set to open on December 12 & will close on December 16, 2025 with a price range of ₹2,061 to ₹2,165.

As one of the country’s largest asset-management firms — backed by ICICI Bank and Prudential Corporation Holdings (UK insurer) — this IPO is being widely watched as a landmark wealth-sector public offering.

What Is The Significance of ICICI Prudential AMC IPO?

ICICI Prudential AMC is one of India’s largest mutual fund houses, offering a varied mix of equity, debt, hybrid, ETF, and other schemes. The AMC occupies a leading position in India’s asset-management ecosystem with an extensive distribution network and strong brand lineage.

The ICICI Prudential AMC IPO is viewed as a move to monetise existing stake, unlock investor value, and provide public-market access to a high-quality AMC.

What Are the Official IPO Dates, Price Band & Issue Size?

| IPO Detail | Information |

| IPO Open Date | 12 December 2025 |

| IPO Close Date | 16 December 2025 |

| Price Band | ₹ 2,061 to ₹ 2,165 per share |

| Issue Size | Approx. ₹ 10,093.33–10,602.65 crore (Offer for Sale of up to 48,972,994 shares) |

| Lot Size (Retail) | 6 shares per lot; minimum investment ~ ₹ 12,990 (at upper band) |

| Listing Date (Tentative) | 19 December 2025 |

Note: The ICICI Prudential AMC IPO is a 100% Offer For Sale (OFS) — no fresh equity is being issued. The offering shares are being sold by the promoter shareholder.

Check ICICI Prudential AMC IPO DRHP: Click Here

What Are the Main Objects of the ICICI Prudential AMC IPO?

The proceeds from this issue will go to the selling shareholder (Prudential Corporation Holdings) after deductions, as this issue is a pure OFS.

In effect, the ICICI Prudential AMC IPO serves to:

- Allow the promoter to monetise part of its stake.

- Provide public investors access to India’s leading AMC.

- Enhance visibility and market valuation of ICICI Pru AMC.

Who Are the Promoters & What Is the Shareholding Pattern?

| Promoter / Shareholder | Current Holding (Pre-IPO) |

| ICICI Bank | 51% |

| Prudential Corporation Holdings (UK) | ~49% |

Since ICICI Prudential AMC IPO is an OFS, there is no fresh issue — so overall promoter holding by ICICI Bank remains unaffected. Prudential Corp sells part of its stake.

How Has ICICI Prudential AMC Fared Financially in Recent Years?

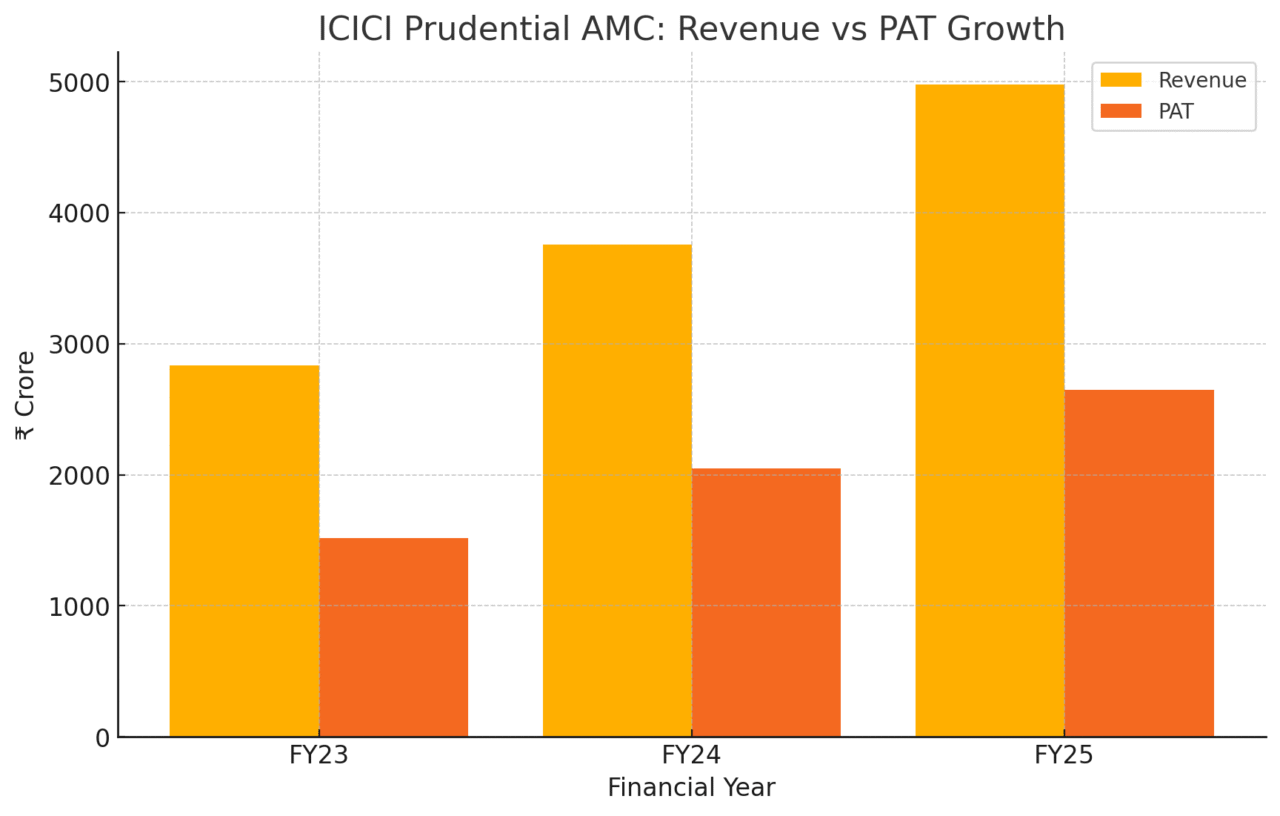

| Period / Year End | Revenue (₹ Crore) | Expenses (₹ Crore) | Profit After Tax (₹ Crore) |

| FY 2023 | 2,837.35 | 831.01 | 1,515.78 |

| FY 2024 | 3,758.23 | 1,063.10 | 2,049.73 |

| FY 2025 | 4,977.33 | 1,446.62 | 2,650.66 |

Financial Trend — Revenue & Profit Growth

This shows a healthy upward trend in both top-line and bottom-line over three consecutive years.

Key Financial Ratios & Valuations

| Metric / Ratio | FY 2025 Value |

| Earnings Per Share (EPS) | ₹ 53.6 |

| Return on Net Worth (RoNW / ROE) | 82.8% |

| NAV (Net Asset Value) per share | ₹ 71.2 |

| Offer Type | 100% Offer For Sale (no fresh issue) |

What Are The Strengths & Competitive Advantages?

- Largest AMC by active mutual-fund QAAUM: ICICI Prudential AMC contributes a ~13.3% market share in quarterly-average assets under management (QAAUM) in India as of September 2025 — making it a leader in the AMC space.

- Diversified Product Suite: The AMC offers 135 diversified mutual fund schemes across equity, debt, hybrid, passive, and other categories.

- Strong Promoter Backing: Joint venture of ICICI Bank (51%) and UK’s Prudential — combining domestic banking strength with global investment experience.

- Debt-free / Light Balance Sheet: As an AMC, it relies on fee-based revenues, and doesn’t carry aggressive debt — reducing financial risk.

What Are the Risks & Potential Weaknesses?

- Market & AUM Volatility: As fee income depends on AUM, any sustained outflow or market downturn could dent revenue and profits.

- Intense Competition: Other large AMCs like HDFC AMC, Nippon Life India AMC, etc., compete aggressively for market share.

- No Fresh Capital Raised: Since IPO is only OFS, the company does not get fresh funds — limiting uses like aggressive expansion or acquisitions.

- Regulatory & Market Risk: The AMC business is subject to regulatory changes (fee structure, compliance) and market sentiment swings which may affect performance.

How ICICI Prudential AMC Stacks vs Listed Peers–Peer Comparison?

| AMC (Peer) | Approx. QAAUM / Market Share* | Key Strength / Differentiator |

| ICICI Prudential AMC | ~13.3% | Largest active AMC by AUM, strong parentage, diversified schemes |

| HDFC AMC | Leading AMC (listed) | Established brand, consistent AUM inflows, performance track record |

| Nippon Life India AMC | Significant share | Competitive fee structure, pan-India distribution reach |

* QAAUM market share as of September 2025 (for ICICI Pru AMC).

ICICI Prudential AMC stands out for its scale, promoter strength, and breadth of product offerings — making it a serious rival to existing listed AMCs.

Conclusion:

The ICICI Prudential AMC IPO offers a good opportunity to investors to get an exposure to one of India’s largest and financially robust asset-management companies. The AMC appears well-positioned for long-term growth amid a strong parentage, leadership in AUM, solid profitability, and wide product range.

For long-term investors who are looking for stable wealth-sector exposure, this IPO could be a compelling option.

Frequently Asked Questions (FAQs) on ICICI Prudential AMC IPO:

1. When will ICICI Prudential AMC IPO open and close?

It opens on 12 December 2025 and closes on 16 December 2025.

2. What is the ICICI Prudential AMC IPO price band?

The IPO price band is ₹2,061 to ₹2,165 per share.

3. What is the minimum lot size and investment amount for retail investors?

6 shares per lot — minimum investment roughly ₹ 12,990 (at upper price band).

4. How much money is ICICI Pru AMC raising via IPO?

Approx. ₹ 10,093–10,602.65 crore, via Offer for Sale (OFS) of up to 48,972,994 shares

5. Is this IPO issuing fresh shares or just promoter share sale?

It is a 100% Offer For Sale — no fresh equity is being issued.

6. On which exchanges will ICICI Pru AMC list?

Listing will be on both the National Stock Exchange of India (NSE) and BSE (Bombay Stock Exchange) – listing date is tentatively 19 December 2025.

Click Here to know more market & IPO related news and updates.

Disclaimer: The views and investment insights provided here are based on publicly available information and do not constitute financial advice. Readers are advised to conduct their own research or consult certified financial experts before making investment decisions.