Pharma IPO Alert! Corona Remedies IPO Opens December 8: Price Band, Key Dates, Financials & Full Investor Review

Corona Remedies IPO is set to hit Dalal Street with a ₹655 crore offer, backed by a strong domestic pharma franchise and rising profitability. With a price band of ₹1,008–₹1,062 and a solid 3-year earnings growth record, the company has caught the attention of both retail and institutional investors.

This analytical breakdown will help you understand whether the Corona Remedies IPO is worth your application.

What Makes Corona Remedies Significant in Indian Pharma?

Corona Remedies Limited is an India-focused pharmaceutical manufacturer specialising in women’s health, cardio-diabetic therapies, pain management and urology drugs. With more than 250 products spread across multiple therapies, the company has steadily grown into a trusted mid-cap pharma player.

Its domestic-focused model, cost-efficient manufacturing and stable distribution network make it competitive against mid-sized peers.

What Are the Corona Remedies IPO Dates, Price Band & Lot Size?

| Detail | Information |

|---|---|

| IPO Opening Date | 8 December 2025 |

| IPO Closing Date | 10 December 2025 |

| Listing Date | 15 December 2025 |

| Price Band | ₹1,008–₹1,062 per share |

| Lot Size (Retail) | 14 shares |

| Issue Size | ₹655.37 crore (100% Offer-for-Sale) |

| Face Value | ₹10 |

| Investors Selling | Promoters + PE Investors |

Check Corona Remedies IPO DRHP: Click Here

Why Is the Corona Remedies IPO Being Launched?

Since the IPO is purely Offer-for-Sale, the company will not receive any new funds.

Key objectives include:

- Listing benefits

- Liquidity for promoters

- Partial exit for private equity investors

This is important for investors who prioritise fresh-issue-driven future expansion.

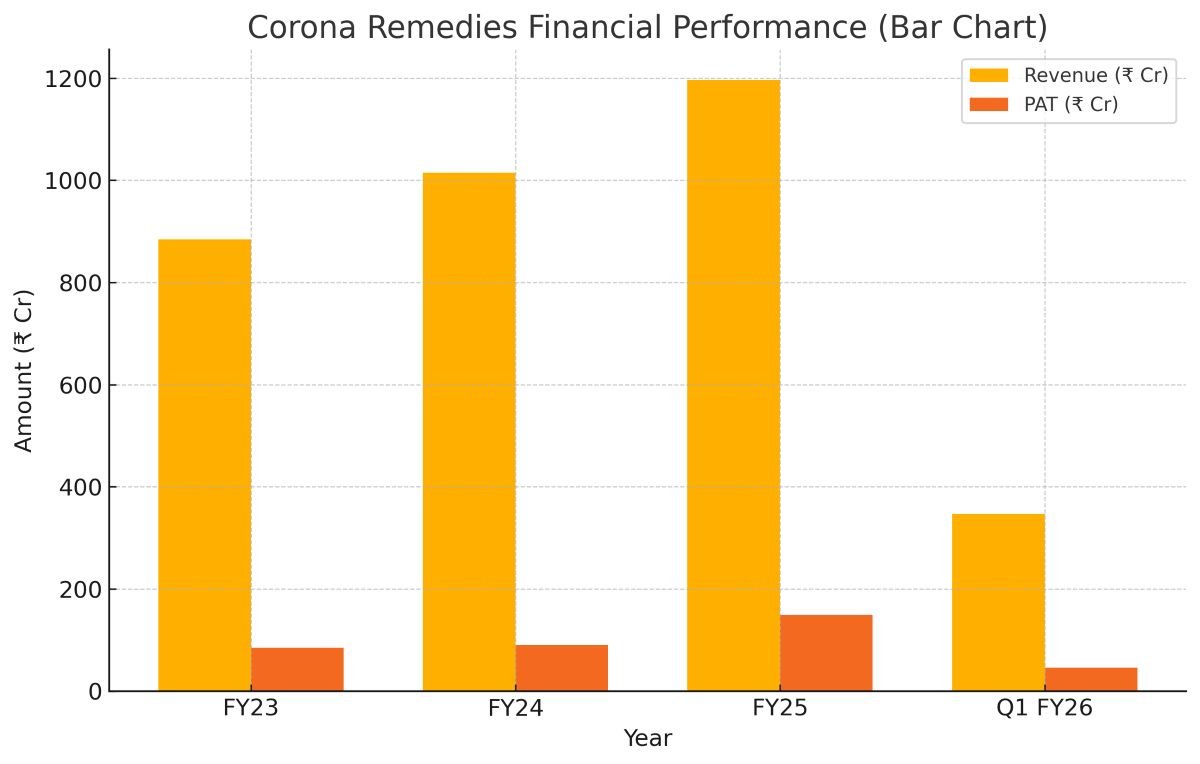

How Has the Company Performed Financially?

Key Ratios

| Ratio | FY23 | FY24 | FY25 |

|---|---|---|---|

| PAT Margin | 9.6% | 8.9% | 12.5% |

| EBITDA Margin | 15.27% | 15.89% | 20.55% |

| RoNW | 20.79% | 18.84% | 24.65% |

| ROCE | 28.36% | 31.19% | 41.32% |

| Debt-Equity | ~0.01 | ~0.05 | ~0.10 |

Who Owns Corona Remedies- Promoter Holding?

| Shareholder Category | Pre-IPO Holding |

|---|---|

| Promoters | ~72.5% |

| Private Equity Investors | Significant |

| Public | 0% (before IPO) |

Promoter holding will reduce post-IPO due to OFS.

What Are the Strengths of Corona Remedies IPO?

✔ Strong domestic pharma presence

✔ Consistent revenue & profit growth

✔ High ROCE and RoNW

✔ Low debt ratio

✔ Diversified therapy portfolio

✔ Scalable manufacturing

What Are the Weaknesses / Risks of Corona Remedies IPO?

✗ 100% OFS – no funds for expansion

✗ Heavy competition in generics segment

✗ Moderately high valuations

✗ High dependence on India revenue

✗ Limited export diversification

Peer Comparison Table

| Company | Revenue (₹ Cr) | PAT Margin | P/E |

|---|---|---|---|

| Corona Remedies | 1,196 | 12.5% | ~41–43× |

| Abbott India | 6,400+ | Higher | ~41× |

| Alkem Labs | 12,900+ | Comparable | ~31× |

Corona Remedies’ valuation is in line but its scale remains far smaller.

Final Verdict — Should You Apply?

Corona Remedies IPO suits investors who want:

- A mid-cap domestic pharma story

- Strong financial fundamentals

- Rising profitability and low leverage

It may not appeal to:

- Growth investors seeking fresh-issue-driven expansion

- Investors preferring large global pharma companies

Overall, it appears suitable for moderate-risk investors with a 2–3 year view.

Corona Remedies IPO Frequently Asked Questions (FAQs)

1. What is the Corona Remedies IPO issue size?

The Corona Remedies IPO issue size is ₹655.37 crore (100% OFS).

2. What is the IPO price band?

The IPO price band is ₹1,008–₹1,062/share.

3. What are the IPO dates?

The IPO dates are 8–10 December 2025.

4. How many shares are in one lot?

14 shares in one lot of Corona Remedies IPO.

5. Is it a fresh issue?

No, the Corona Remedies IPO is a complete OFS.

6. Who are the promoters?

The promoters are Dr. Kirtikumar Laxmidas Mehta, Niravkumar Kirtikumar Mehta and Ankur Kirtikumar Mehta.

7. What is the Corona Remedies listing date?

The Corona Remedies IPO listing date is December 15, 2025.

8. How has financial performance been?

The financial performance shows consistent growth with strong margins.

9. Is the company debt-heavy?

No, the company is extremely low debt.

10. Is the Corona Remedies IPO good for listing gains?

Moderately positive based on valuation and performance.

Click Here to know more market & IPO related news and updates.

Disclaimer: The views and investment insights provided here are based on publicly available information and do not constitute financial advice. Readers are advised to conduct their own research or consult certified financial experts before making investment decisions.