Excelsoft Technologies IPO: Know Price Band, IPO Dates & Full Investment Guide!

Excelsoft Technologies IPO: The forthcoming initial public offering of Excelsoft Technologies Limited (ETL) presents a fresh‐entry play into the Indian SaaS and ed-learning segment – a space buzzing with global tailwinds.

As Indian retail and institutional investors gear up, it’s crucial to examine the Excelsoft Technologies IPO key stats, the company’s business model, its financial track record and the risks alongside the potential. This article decodes with an India-flavour research style, serving you actionable insight ahead of the subscription window.

What is Excelsoft Technologies & Why It Matters?

Founded in 2000 and headquartered in Mysore, Karnataka, Excelsoft Technologies is a vertical SaaS player specialising in learning & assessment platforms, digital content solutions, e-books, AI-based proctoring and enterprise services.

The company has over two decades of domain experience, serves global clients across ~19 countries and deploys offerings to educational institutions, certification bodies, publishers and corporates. With edtech and digital assessment gaining traction globally, Excelsoft seeks to ride this wave—and the IPO is part of its growth strategy.

When, How Much & Other Excelsoft Technologies IPO Facts?

| Parameter | Details |

|---|---|

| Opening date | 19 November 2025 |

| Closing date | 21 November 2025 |

| Price band | ₹ 114 to ₹ 120 per share |

| Lot size | 125 shares (≈₹ 15,000 at upper band) |

| Issue size | ₹ 500 crore approx (Fresh ₹180 cr + Offer for Sale ₹320 cr) |

| Reservation | QIB: up to 50 % / Retail: at least 35 % / NII: up to 15 % |

| Expected listing date | 26 November 2025 on NSE & BSE |

What Will the IPO Proceeds Fund?

| Object | Approx. Amount | Notes |

|---|---|---|

| Land purchase & new building – Mysore property | ₹ 61.7 crore | For capacity expansion |

| Upgradation & external electrical systems – existing Mysore facility | ₹ 39.5 crore | Infrastructure support |

| Upgradation of IT infrastructure (software/hardware/communications) | ₹ 54.6 crore | Tech stack & scalability |

| General corporate purposes | Balance from fresh issue |

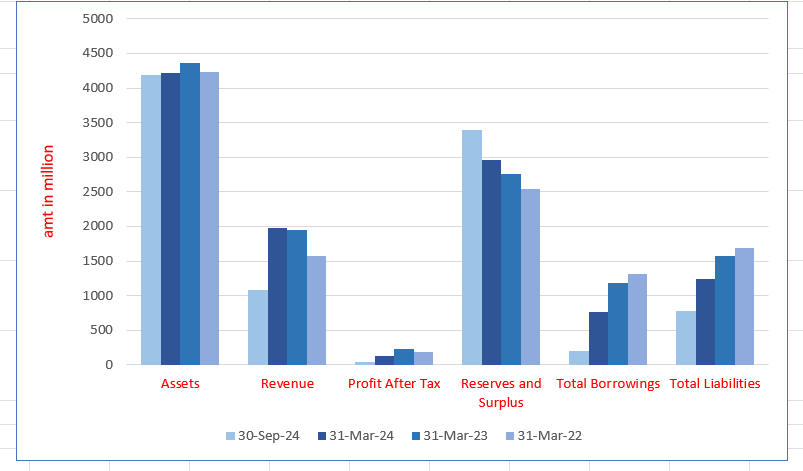

Financial Snapshot & Key Ratios

Financials (₹ in crore)

| Year | Revenue | PAT |

|---|---|---|

| FY 23 | 195.10 approx | 22.41 |

| FY 24 | 198.30 approx | 12.75 |

| FY 25 | 233.29 approx | 34.69 |

Key ratios

- PAT margin: ↑ from ~11.5% (FY23) → ~14.9% (FY25)

- RoCE: ~11.0% in FY23 → ~16.11% in FY25

- Debt‐to‐Equity: improved to very low levels by FY25

- Implied P/E at upper band ~39.8x (FY25 earnings)

Note: The diagram above visually captures revenue & PAT growth and the promoter/investor holding changes due to the IPO.

Who’s Behind the Company (Promoters)

Promoters consist of:

- Pedanta Technologies Private Limited

- Mr. Dhananjaya Sudhanva (Chairman & MD)

- Ms. Lajwanti Sudhanva (Non‐Executive Director)

- Ms. Shruthi Sudhanva (Whole‐Time Director)

Shareholding pre and post‐IPO

| Holding | Pre‐Issue | Post‐Issue |

|---|---|---|

| Promoter & promoter‐group | ~94.6% | ~59.1% |

This significant dilution (via OFS by Pedanta Technologies) means public participation will rise and promoter skin remains substantial.

Strengths & Weaknesses – What to Consider?

Strengths

- Focused on a niche vertical (learning & assessment SaaS) with global reach.

- Good profitability improvement and low debt.

- Clear growth use‐case: land, infrastructure, IT stack to scale.

Weaknesses / Risks

- High client concentration (one large client reportedly ~58–59% of revenues) which raises performer‐risk.

- Revenue growth has been moderate (single‐digit CAGR) despite profitability improvement.

- IPO valuation not bargain‐priced (~40x P/E on FY25) – room for listing buffs, but also risk of muted return.

- Execution risk: scaling globally, managing infrastructure capex, converting SaaS backlog into growth.

Peer Comparison – How Does It Stack Up?

| Company | Revenue (₹ cr) | PAT Margin | RoCE | P/E* |

|---|---|---|---|---|

| Excelsoft Technologies | ~233 | ~14.9% | ~16.1% | ~39.8x |

| MPS Ltd | ~727 | ~20% | ~41% | ~24x |

| Ksolves India Ltd | ~137 | ~25% | ~157% | ~24x |

*P/E and other ratios approximate based on available data.

Observation: Excelsoft trades at a premium relative to some peers, justified by niche positioning but requiring strong execution.

Conclusion

In a nutshell, Excelsoft Technologies IPO offers Indian investors a chance to participate in a well-established SaaS/EdTech entrant with global exposure and improving margin metrics. That said, the valuation is premium, growth has been modest in past years, and client concentration remains a risk.

For those bullish on the segment and comfortable with the risks, this IPO could be a meaningful addition. But for value-seeking or ultra-short‐term traders, caution is advised.

Excelsoft Technologies IPO Frequently Asked Questions (FAQs)

1.What’s the minimum investment required?

Minimum one lot = 125 shares at upper band ₹120 → approx ₹15,000.

2. When will shares be listed?

Tentatively 26 November 2025 on BSE & NSE.

3. What is the fresh issue vs OFS split?

Fresh issue ~₹180 cr + OFS ~₹320 cr = total ~₹500 cr.

4. What is the Excelsoft Technologies IPO lot size?

125 shares per lot.

5. What will be the promoter shareholding post-IPO?

Approximately 59.1% post‐issue.

6. What are the key strengths of the company?

Niche SaaS focus, global client base, margins improving, low debt.

7. What are the key risks?

Client‐concentration, moderate revenue growth, premium valuation.

8. What valuation am I paying?

Based on FY25 PAT, implied P/E ~39.8x at upper band.

9. Who are the key competitors/peers?

Peers include MPS Ltd, Ksolves India Ltd among others.

10.What will the IPO proceeds be used for?

Land & building construction in Mysore, facility upgradation, IT infrastructure, and general corporate purposes.

Click Here to know more market & IPO related news and updates.

Disclaimer: The views and investment insights provided here are based on publicly available information and do not constitute financial advice. Readers are advised to conduct their own research or consult certified financial experts before making investment decisions.